Product margin formula

The Eastern company sells a single product known as product-X. Variable costs total 1000.

How To Calculate Measure The Difference Between The Selling Price And The Cost Price Of A Product Or Service Financial Management Gross Margin Business Tools

The contribution margin is 6000 - 1000 5000.

. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. Contribution margin Sales revenue Variable expenses. The contribution margin ratio shows a margin of 60 600010000.

Profit percentage is of two types. The formula should divide the profit by the amount of the sale or C2A2 100 to produce a percentage. This means that the cost it takes to produce and get the product to the consumer is greater than the revenue gained from the sale of.

When you put that value into the gross profit margin formula youll discover that. Heres the formula to calculate gross profit. Those direct costs are also called cost of goods sold COGS.

Input a formula in the final column to calculate the profit margin on the sale. Sales Revenue - Cost of Goods Sold Gross Profit. For example consider the following income statement for.

0624 converted to a percentage becomes 624. The selected data of. Gross margin serves as an indicator of how well the business is managing its product and service-related expenses and sales.

But this same café also sells muffins. It tells you how much profit each product creates without fixed costs. N the number of samples Nthe total population How a sample size calculator works.

Gross margin Total revenue - COGSTotal revenue x 100. The formula to calculate gross margin as a percentage is Gross Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales.

The formula to calculate gross margin is. Gross profit margin looks at what percentage of profit youre keeping compared to how much your products costing. The gross profit margin formula is.

For investors the margin of safety serves as a cushion against errors in calculation. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook. Gross Margin Formula Example 2.

Understanding Margin of Safety. The profit margin formula is a simple method of calculation and it goes as follows. Thats an extremely high profit margin.

A company has revenues of 50 million the cost of goods sold is 20 million marketing is 5 million product delivery fees are 5 million and fixed costs are 10 million. This formula is used when you dont have enough information about a populations behavior or the distribution of a behavior to otherwise know the appropriate sample size. Gross Profit Sales Revenue Gross.

The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses and is expressed as a percentage of cost price or selling price. A Markup expressed as a percentage of cost price. We can represent contribution margin in percentage as well.

That is the difference between per unit selling price and the per unit variable cost of your product. Firms use it to compare product. See an example in Excel here.

Gross Profit Margin Gross Profit Revenue. The profit margin formula is. The basic breakeven model for calculating the margin of Safety can be adapted to multiproduct environments.

Margin of safety is a particularly important measurement for management when they are contemplating an expansion or new product line because it shows how safe the company is and how much lost sales or increased costs the. Your gross profit is 45 because. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost.

The contribution margin ratio shows a margin of 83 50006000. Read this article to understand the importance of higher contribution margin products for a multi product company. The Gross Profit Margin shows the income a company has left over after paying off all direct expenses related to manufacturing a product or providing a service.

Slovins formula is written as. Profit Margin is 69. Product Cost Direct Material Cost Direct Labor Cost Manufacturing Overhead Cost.

Great if I can sell a quilt for 880 but that high of a profit margin likely prices my quilt out of the market. B Profit margin which is the percentage calculated using the selling. For example if you sell a T-shirt for 100 it costs you 55 to make and ship it to your customer.

The traditional pricing formula is based on one product Materials are 20 labor is 200 20hour x 10 hours not 20 as youre stating with 220 being the. Here is the formula for contribution margin ratio CM ratio. Calculating the margin of Safety for multiple products is the same as for single products but we use the standard mix.

Gross margin revenue - COGS revenue. Contribution margin dollars. That sounds like a good result.

The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. Since fair value is difficult to predict accurately safety margins. Gross Margin 38.

Contribution Margin Per Unit is the profit that remains on selling the single unit of your product. Gross margin is usually represented as a percentage while gross profit is represented as a dollar value. Or adopting a more profitable product mix.

Example Calculation of Contribution Margin Ratio. Unit contribution margin per unit denotes the profit potential of a product or activity from the. Calculating the Margin of Safety in percentage.

The equation or formula of contribution margin can be written as follows. Finally the formula for product cost can be derived by adding direct material cost step 1 direct labor cost step 2 and manufacturing overhead cost step 3 as shown below. N N 1Ne2 Where.

Cost of goods sold could include labor materials and overhead costs. The margin of safety formula is equal to current sales minus the breakeven point divided by current sales. Variable costs are any costs incurred during a process that can vary with production rates output.

The Revenue from all muffins sold in March is 6000. The margin of Safety in percentage 20. For the year ended.

Gross margin shows the revenue a company has left over after paying all the direct expenses of manufacturing a product or providing a service. 100 net sales - 45 COGS 45 gross profit. Sales - Total Expenses Revenue x 100 Gross Profit Margin This margin compares revenue to variable costs.

In cost-volume-profit analysis a form of management accounting contribution marginthe marginal profit per unit saleis a useful quantity in carrying out various calculations and can be used as a measure of operating leverageTypically low contribution margins are prevalent in the labor-intensive service sector while high contribution margins are prevalent in the capital. Relevance and Uses of Product Cost Formula. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio.

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

How To Calculate Gross Margin Percentage Gross Margin Percentage Calculator

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Retail Markup Calculator Markup Pricing Formula Excel Margin Formula

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

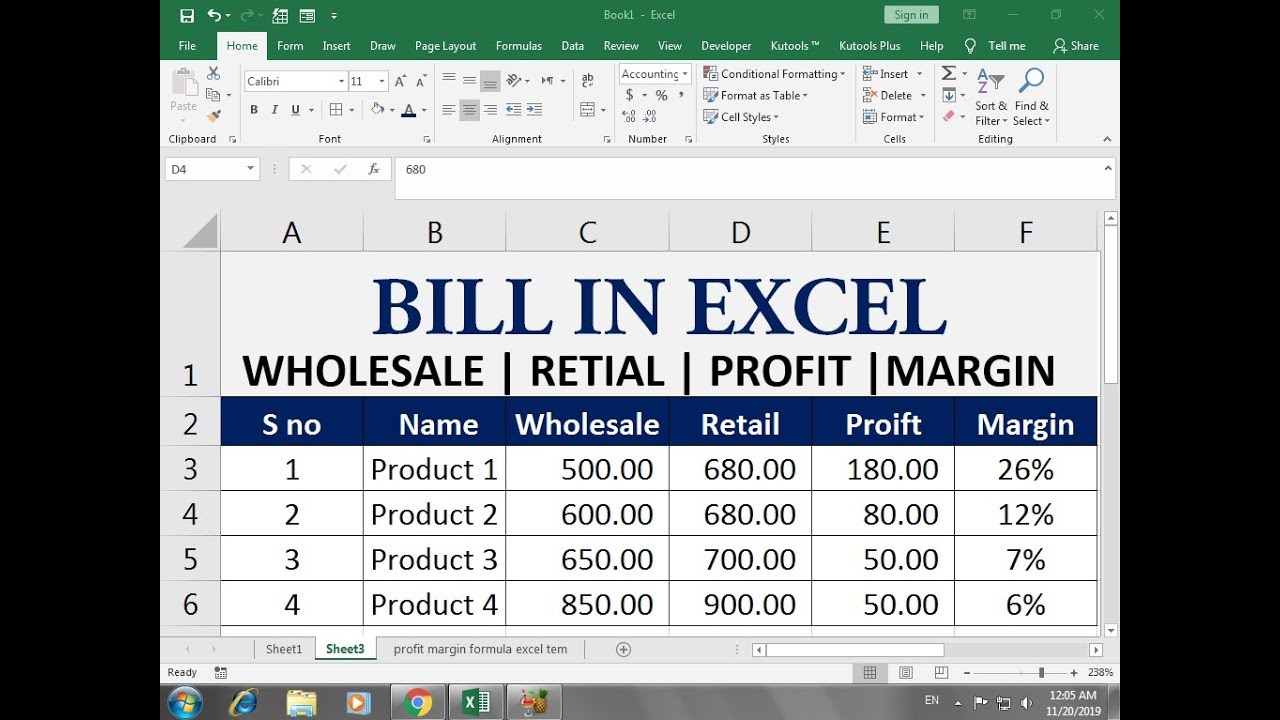

How To Calculate Profit Margin With A Simple Formula In Excel Youtube Excel Free Online Courses Online Courses

Margin Vs Markup Chart How To Calculate Margin And Markup Accounting Bookkeeping Business Business Analysis

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Knowing How Much Your Products Cost You To Make And How To Price Them In A Way That Will Make You Money Is As Food Business Ideas Food Truck Business Food

Distribution Channel Margin Calculator For A Startup Plan Projections Start Up Channel Business Planning

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

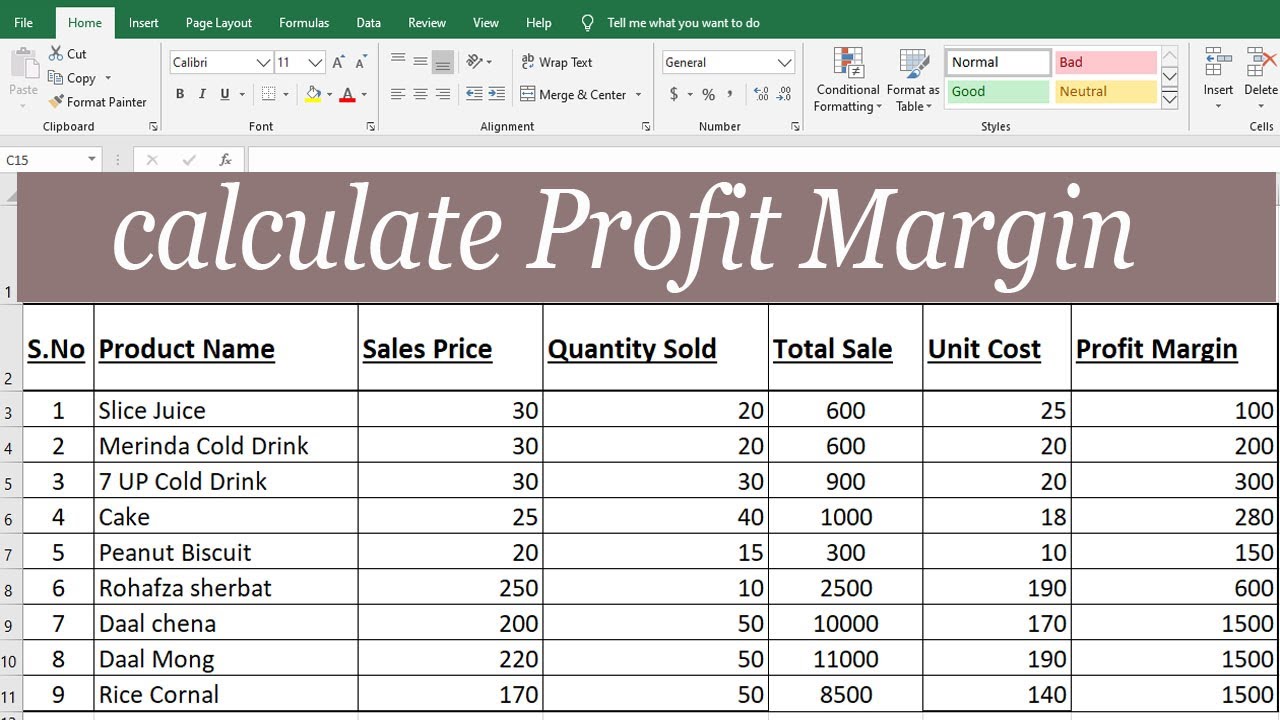

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel